Integrating ESG (environmental, social, and governance) concerns into the core of your business can benefit the bottom line without compromising shareholder value.Some companies have even found that integrating sustainability into their operations has led to higher returns on equity, better internal business practices, and, ultimately, more robust performance across the board.

Integrating ESG Into Business Need Strategy

The challenge of integrating ESG into the next phase of business growth is a challenging one. One of the biggest challenges is our heavy reliance on coal.

It will be hard to convince people that the economy and society cannot continue living as they had been. However, when businesses see the benefits, they will understand that this is a necessary step in our evolution as a species—that sustainability is better for the planet and for business.

Net-Zero Carbon Emissions

Net Zero, or becoming carbon neutral, implies not adding greenhouse gases to the atmosphere. Green Hydrogen (GH) may account for 12% of global energy use by 2050. Globally governments are fast-tracking use of GH2, its production, storage, and logistics, through various incentives and programs.

Integrating ESG into the Next Phase of Business Growth

Environmental, Social and Governance (ESG) factors are becoming a global phenomenon, placing companies under increasing scrutiny. This heightened stakeholder focus indicates that boards are confronted with new expectations. However, not many global organisations and their leaders are equipped to adopt ESG issues in their business goals.

In addition to external pressures to address ESG issues, more and more organisations are also realising the benefits of embedding ESG criteria in their financial & business practices to reduce their exposure to a range of risks, and to improve their baseline performance, which will be sustainable over the long term.

Our recently held webinar, ‘Sustainability and the next phase of Business Growth’ stressed on the key facets that have an impact on the organisations’ ESG metrics. Our illustrious panellists’ captivating & forward-looking visions & experiences will surely not just be an eye opener for companies, they will also offer companies a great head start towards implementing ESG agenda in full throttle.

Compliance with ESG Reporting Frameworks and ESG Scores can be strategic tools if used correctly.

To be a true leader in an ethical and sustainable business, companies must report on their progress toward these goals and strive to improve continuously. However, how a company reports on its sustainability efforts will vary depending on the framework(s) and scores it chooses to use.

Mr. Sanjay Desai, Co-Founder & Regional Director at Humana International Group, stresses that compliance with ESG reporting frameworks and ESG scores can be strategic tools if used correctly.

In order to meet the requirements of responsible reporting, companies should be transparent about how they report their ESG efforts. The goal of any company should be to achieve greater transparency, not just compliance with ESG frameworks and scores.

Questions and answers on Humana International Group regional director’s last webinar may provide an overview regarding integrating ESG into the next phase of business growth.

Is ESG a process cadence or an application tool? How should businesses get aligned to it?

ESG represents an organization’s operational, business processes, and financial efficiencies, focusing mainly on sustainable and ethical impacts on society and the environment.

Capital markets use ESG to evaluate organizations and determine future financial performance.

While ethical, sustainable, and corporate governance are considered non-financial performance indicators, their role is to manage an organization’s impact, such as carbon footprint, GHG emissions, and use of scarce resources (esp. water).

Environmental Factors

Environmental factors are climate change, energy consumption, and how much an organisation works to protect these resources and their impact on the environment.

Social Factors

Social factors guide how an organisation treats its human capital and personal data protection & inculcate diversity and inclusion across the entire organisation physically.

Governance

Governance, as the word indicates, validates how organisations develop their corporate policies addressing internal checks and balances, transparency in reporting, integrity, and ethics in their business transactions and dealings within and outside their organisations.

ESG has many different perspectives. You can look at it through a health and safety lens or a risk management lens, or a reporting lens. On this note, I would like to echo a quote from the great leader, Mr. Mahatma Gandhi, “What we are doing to the forests of the world is but a mirror reflection of what we are doing to ourselves and to one another.

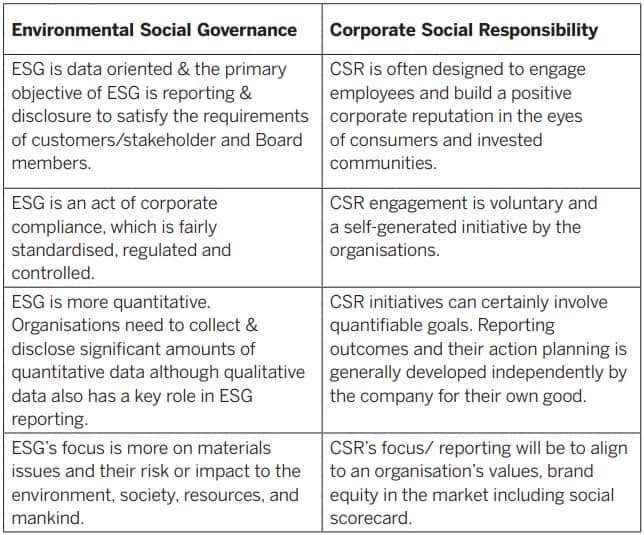

For a long time, we have heard about CSR. Are ESG and CSR the same or two different ends of the corporate philosophy?

ESG is a process tool that helps organisations understand how they manage their operations’ impact on the environment / social cause / GHG emissions / CO2 disposition. This framework helps them balance their financial investment v/s social and environmental impacts and gauge future risks and opportunities. ESG focuses on the material issues of an organisation.

CSR (Corporate Social Responsibility) is a form of self-regulation that reflects a business’s accountability and commitment to the well-being of communities and society through various environmental and social measures.

It is a strong belief that CSR plays a crucial role in a company’s brand perception; attractiveness to customers, and their investors, helps retain talent, and shows overall business success.

An organisation can implement four types of CSR efforts: environmental initiatives, charity work, ethical labour practices, and volunteer projects.

There are subtle differences, let us take a look at a few of them.

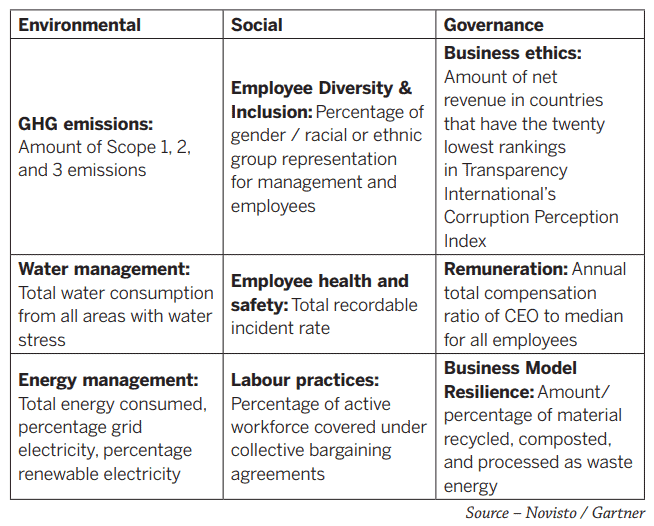

What are the ESG metrics? Are they managed in the similar way as business metrics?

Interesting question… ESG metrics are indeed similar to business metrics in the way they decipher the data or both have similar quantitative and qualitative KPI formats. However, the outputs they track are different.

ESG metrics are used to assess a company’s performance related to environmental, social, and governance issues, which, in turn, indicates whether an organisation is creating, reducing, or preserving the impacts to the environment, mankind, and resources.

These metrics will include indicators such as GHG emissions intensity, amount of waste generated, and gender diversity in an organisation.

Traditionally investors were looking at financial metrics or financial outcomes to judge the performance & quality of an organisation. But it has changed in the recent past.

Now most investors also consider ESG metrics alongside financial data to access the viability and long-term performance of organisation in a more ‘sustainable’ way.

Table below looks at a few metrics deeply.

What is a Carbon market and how can an organisation be a part of it?

In simplistic form, carbon markets are trading systems where many organisations/ institutions sell and buy carbon credits.

Carbon markets are still in their infancy and currently lack quality and credibility; technology can help in promoting transparency, integrity, and usage. While the carbon markets are considered legitimate globally, they do have their own issues.

For example, a question comes to mind, does the carbon credit create real-world decarbonisation, and would that carbon emission be (really) offset if the credit was not purchased?

Hence organisations who buy carbon credits need to ensure carbon offsetting is only utilised for the part of emissions that cannot be abated. While claims and offset quality may vary, offsets are on the rise, and there is a need for carbon credit markets to be vigilant, credible, and transparent.

There are Two Types of Carbon Markets

Regulatory or Compliance market:

This market has been getting bigger and bigger each year for the last few years. At present, the global market size could be in the vicinity of US$265-275 billion.

According to World Bank, over 47 national jurisdictions represent more than 20% of global GHG emissions.

At a ballpark, academics estimate the real price of GHG emissions to be around $200 per tonne of CO2e.

However, the actual cost will vary from country to country.

Voluntary carbon market:

This market is much smaller, fragmented, and largely private, with varying standards. The market size is estimated to be from $400 million to US$2 billion.

The cost of carbon credits varies, particularly for carbon offsets, since the value is linked closely to the perceived quality of the issuing company.

Typically, voluntary credits are purchased by private companies all over the globe who want to compensate for their carbon footprints, especially those corporations with strict sustainability targets and net-zero strategies.

Over the last few years, supply chain is on the sustainability media radar. A few new terms we hear are “Sustainable Supply Chain Finance”, what does this mean?

Over the last few years, supply chain has been in the limelight for many right or wrong reasons… As the term indicates, these are two processes combined (Sustainability and Supply Chain Finance).

From a practical definition point of view, sustainable supply chain finance is defined as financial practices and techniques that support trade transactions in a manner that will help reduce negative impacts and create environmental, social, and economic benefits to all stakeholders involved in bringing products and services to markets. Everyone is a winner in this process – The manufacturer, borrowers, lenders, consumers, and trade.

Sustainable finance means investing money into organisations that demonstrate social values, good governance, and diversity & inclusion in their staff. It also means investing money in financial institutions / private funds managers who invest in their funds (lending) based on ESG principles.

Sustainability has rapidly become a core consideration in today’s corporate supply chain discussion, largely driven by consumers and investors looking for more ethical manufacturing practices from the companies they buy from and invest in.

Similarly, on banking and trade finance front, having access to sustainable-labelled finance solutions is critical for corporates to meet their ESG goals, whether it is reducing emissions or ensuring fair wages and working conditions among their suppliers.

While the above sounds very promising, please note that these are purely corporate / Industrial or Institutional investors with big pockets and can access big data.

For them, more is merrier. For end consumers like small retail investors or us to openly embrace sustainable investments, the financial market needs to be much more easily accessible & consistent with a personalised sustainability approach.

There is always room for improvement, given the advancement we have made on the technology spectrum. How are technology companies leveraging and leading the way in this global phenomenon?

Yes, data science and analytics will guide organisations to follow ESG principles to the core.

Imagine that in the last turbulent three years, almost every industry suffered in some way or another, but it is only the technology industry that remained relatively calm and resilient.

They stood strong during the pandemic, and many of them had double-digit growth during 2021-22.

In order to see their growth, especially the tech start-ups who stand to benefit further with a renewed focus on ESG, one of the silver linings in an otherwise disastrous Covid-19 aftermath.

The technology industry is a significant contributor to the global carbon footprint, and almost 60% of IT industry emissions come from their hardware used by customers.

This explains why these organisations are at the forefront of the corporate push for green energy globally. This also acts as a catalyst for other industries to invest & adopt similar technology and follow suit on their growth path.

The big five tech companies (Amazon, Apple, Facebook, Google, and Microsoft) are all setting targets to use 100% renewable energy. Most of these industry players intend to be carbon-negative by as early as 2030.

In one example, datacentre providers in Singapore have had to be resourceful in their search for renewable energy since the government has been critical of the industry’s large carbon footprint.

In March 2021, solar energy provider Sunseap, which works with Microsoft and Apple’s datacentres in Singapore, unveiled a floating solar farm that could produce an estimated six-million-kilowatt hours of energy per year at 5MW peak installation.

Industry participants are also discussing the expansion of datacentres powered by onsite generated hydrogen.

There is always room for improvement, given the advancement we have made on the technology spectrum. How are technology companies leveraging and leading the way in this global phenomenon?

Yes, data science and analytics will guide organisations to follow ESG principles to the core.

Imagine that in the last turbulent three years, almost every industry suffered in some way or another, but it is only the technology industry that remained relatively calm and resilient.

They stood strong during the pandemic, and many of them had double-digit growth during 2021-22.

In order to see their growth, especially the tech start-ups who stand to benefit further with a renewed focus on ESG, one of the silver linings in an otherwise disastrous Covid-19 aftermath.

The technology industry is a significant contributor to the global carbon footprint, and almost 60% of IT industry emissions come from their hardware used by customers.

This explains why these organisations are at the forefront of the corporate push for green energy globally. This also acts as a catalyst for other industries to invest & adopt similar technology and follow suit on their growth path.

The big five tech companies (Amazon, Apple, Facebook, Google, and Microsoft) are all setting targets to use 100% renewable energy. Most of these industry players intend to be carbon-negative by as early as 2030.

In one example, datacentre providers in Singapore have had to be resourceful in their search for renewable energy since the government has been critical of the industry’s large carbon footprint.

In March 2021, solar energy provider Sunseap, which works with Microsoft and Apple’s datacentres in Singapore, unveiled a floating solar farm that could produce an estimated six-million-kilowatt hours of energy per year at 5MW peak installation.

Industry participants are also discussing the expansion of datacentres powered by onsite generated hydrogen.

Conclusion

Sustainability has rapidly become a core consideration in today’s corporate supply chain discussion, driven in large part by consumers and investors looking for more ethical manufacturing practices from the companies they buy from and invest in.

Similarly on banking and trade finance front, having access to sustainable-labelled finance solutions is key for corporates to meet their ESG goals, whether it is reducing emissions or ensuring fair wages and working conditions among their suppliers.

Read also: Healthcare Industry Trends After COVID-19 Pandemic

Companies are under more pressure than ever to create value for their shareholders by reporting on ESG issues, implementing sustainable business practices, and integrating ESG into their metrics.

Yet, companies that attempt to jump into the complex world of ESG metrics without a strategy for integrating them with core business initiatives often get stuck in a cycle of spending too much time and money on ESG issues that do not drive long-term value creation.